tax on unrealized gains canada

As the rules are currently written only 50 of a capital gain is subject to tax in Canada. A capital gains tax is a levy on the profit that an investor makes.

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

An unrealized capital gain occurs when your investments increase in value but you havent sold them.

. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Do you pay tax on unrealized gains Canada. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

There are seven federal income tax rates in 2023. Unrealized gains and losses on foreign exchange please contact a member of the EPR Maple Ridge Langley team by filling out the contact form. OTTAWA The laws governing prostitution in Canada not sex work itself are.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Because you only include onehalf of the capital gains from these properties in your taxable. Citizen moves back to the United States after having been a Canadian.

You report the disposition of capital property in the calendar year January to December you sell or are considered to have sold the property. If you have any questions about realized vs. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

Canada assesses an exit tax on any unrealized capital gains inside taxable accounts in cases where the US. Under Canadian income tax law gains or losses on income account are fully included or. As we head toward another federal budget to be released on March 22 there is much speculation about a change in the capital.

When to report a gain or loss. Canadians pay a 50 tax on all of their capital gains. Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a capital asset.

For example if you were ahead of the curve and bought bitcoin for 100 and now its worth 9100 you have an unrealized gain of 9000. Do you have to pay taxes on unrealized crypto gains. See also Tax Notes IntlNov10 2008 p.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Because of this the actual amount of extra tax you owe will vary according to your earnings and other income sources. Your sale price 3950- your ACB 13002650.

Since its more than your ACB you have a capital gain. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment.

The good news is you only pay tax on. Unrealized Capital Gains. The sale price minus your ACB is the capital gain that youll need to pay tax on.

459 Doc 2008-23127or2008 WTD 212-1. 2See section 261 of the ITA. If you decide to sell youd now have 14 in realized capital gains.

Tax-deferred rollovers and stop-loss rules under the Income Tax Act Canada.

Turning Losses Into Tax Advantages

Northern Trust Wealth Management Asset Management Asset Servicing

The Capital Gains Tax And Inflation How To Favour Investment And Prosperity Iedm Mei

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

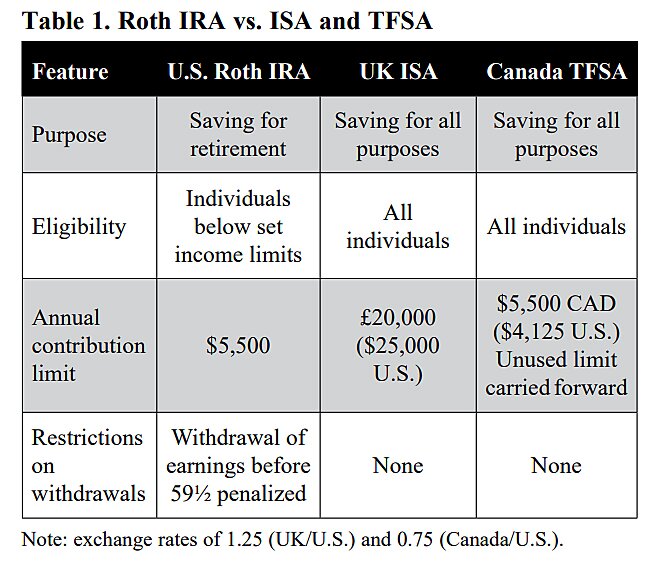

Tax Reform And Savings Lessons From Canada And The United Kingdom Cato Institute

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Capital Gain Definition Types Corporate Tax Rates Example

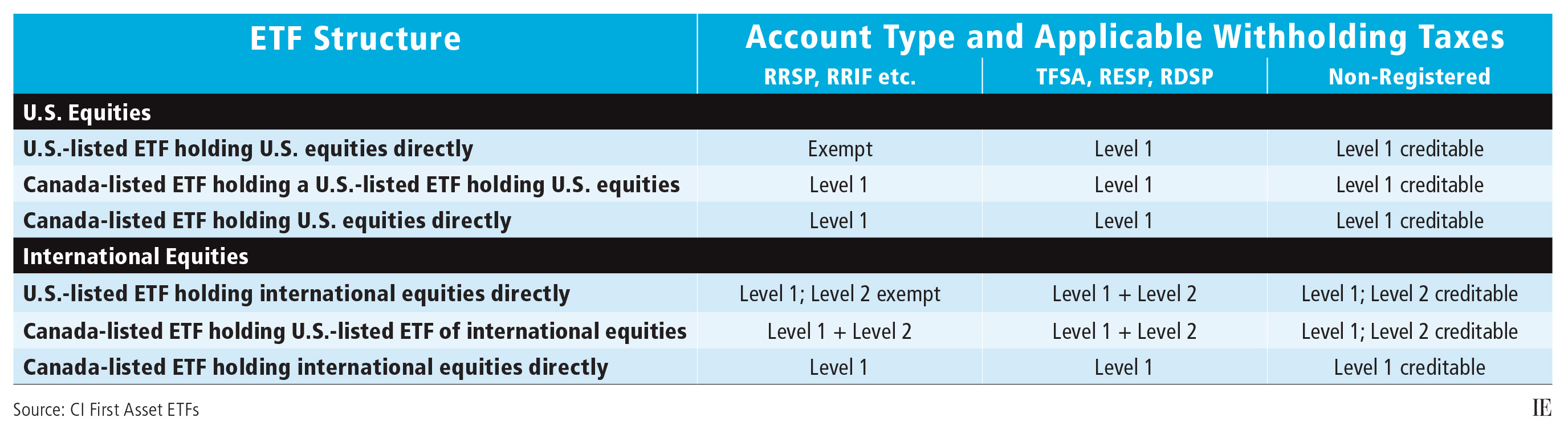

Etfs And Foreign Withholding Taxes Investment Executive

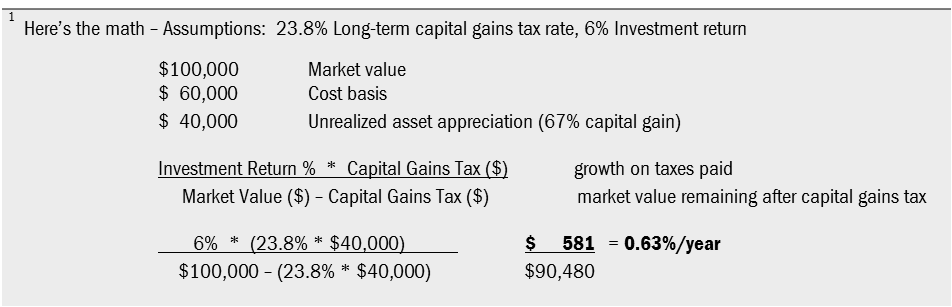

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

2021 Capital Gains Tax Rates In Europe Tax Foundation

High Class Problem Large Realized Capital Gains Montag Wealth

Crypto Tax Loss Harvesting Investor S Guide Koinly

10 Best Crypto Tax Software In 2022 Top Selective Only

Taxation Of Investment Income Within A Corporation Manulife Investment Management